Within a week on my first Dynamics AX (ERP) project I realized it is not hard to make a fool of oneself. Technically I am there. Have been reading up a lot about AX architecture and development environment. But once the customer application walk-through started, it was so hard to follow the discussion. Not that I can’t understand business process. If anything i consider myself very good at grasping business processes, but the problem was all that financial talk. Journal, Ledger, main account, offset account, debit, credit.. WHAT THE??….. aaaaaaaaaaaahhhhhhhhhhhhh.

Anyway so the past few weeks I have been educating myself on financial accounting basics. And here i will try to summarize a bit of what I learnt. It is always hard to blog about a topic we are just learning, but then again I hope to crystallize my thoughts by blogging them.

Here are the topic I am going to touch on. I hope to expand on this as I learn more.

- Chart of Accounts

- Accounting equation

- Double entry book-keeping

- General Journal

- Credit/Debit

- General Ledger

In its simplest terms accounting is trying to put into different categories your money inflows (income) and outflow (expense). For each category say we create a separate account (say a variable). For eg. lets create an account for tracking salary earned. Anytime we get paid salary we will increase the value in this account/variable. This brings me to the first important accounting concept called Chart of Accounts. Chart of accounts is nothing but a list of all the different accounts that you will create that together should allow you to track all money inflow/outflow.

Lets talk of another important accounting concept which can be defined as a an equation. Assets = Liabilities + Owners Equity (A=L+OE). OE is a sum of Equity+Retained Earnings (RE). Retained Earnings is equal to previous years Total Income – Total Expenses. So to expand the above equation A=L+Equity+I-E. Example time: Say you earned $1000 in a month then this amount increase one account which is your Bank Account. But this is also your equity, that means if we were to technically create an account called Owners Equity then that will increase by 1000. If you were to treat your home as a business, then from the point of view of your business it has an asset of BankBalance=1000 and liability (to you) as OE=1000.

Now lets move to the next concept called double entry book-keeping. Double entry means create multiple entries, one set of entries recording increase and another set of accounts recording decreasing. The key rule is that the sum of all increases should be equal to sum of all decreases. The example i described is a case of double entry system. Double entry flows very logically from the equation we defined above that the left hand side must balance the right hand side. So if we were to originally start with $2000. Then Bank Account=$2000, OE=$2000. Suppose for the month you had to spend $1000 as living expenses then you have to withdraw it from your bank account so now Bank Account=$1000, OE=$2000 and Expenses=$1000. Going back to the equation above it is still balanced. So the balanced entries are Bank Account $1000, Expense $1000.

Too much already? Cmon you can keep reading. Lets talk of Journals now. In its simplest terms a Journal represents a book for making entries every time any monetary transaction takes place. A journal always creates matching entries so that the accounting equation is maintained. There are a number of different types of journals, and the most basic journal where you can record any kind of entry is General Journal. Question time: If you paid $100 towards you car insurance for the month then what entry would you make in the journal? Answer: There will be 2 entries, Increase Car Insurance expense by $100 and decrease bank cash by $100. There are also specific journals where you record more specific entries. For example Sales Journal, Purchase Journal, Cash Receipts Journal, Cash Payments Journal etc..

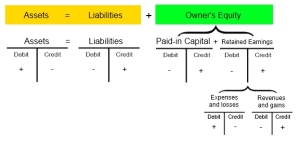

Now we come to one of the most confusing parts of accounting, the use of terms Credit and Debit. Generally our understanding would be Credit means increase and Debit means decrease. That is not entirely true though. Credit and Debit get applied differently based on which side of the accounting equation the entry is on. For right hand side of equation you would be Right in thinking Credit means add to an account and debit means decrease to an account. The exact opposite is true for the left hand side. Credit is decrease and debit means increase. Remember though the items should be +ve on the equation. So although I wrote expense on right, it is actually negative prefixed. So bring Expense to left hand side. Thus Credit would decrease and expense account and debit would increase it. Also every journal entry should have matching totalling Debit entries and Credit entries. That is, sum of all debits should be equal to sum of all credits. Taking the example of car insurance expense the entries would be Debit Bank Account (decrease cash) and Credit Car Insurance expense (increase expense).

Finally we come to General Ledger. A general ledger has one entry for each of the account in chart of accounts. Again the sum of the debits would match the sum of the credits. Basically you take all entries from all journals and total the amounts for each account in chart of accounts. Now this total is one number and this is posted as one entry for each account in general ledger.

I know this is a little late as this post is 2 years old but I bumped into your blog after reading your great post on the Intro to Transportation Logic in R3.

Just a little correction for anyone reading: Assets and Liabilities are Balance sheet accounts and Expenses and Revenues are Income statement accounts.

Therefore with the car insurance example the Bank account is an Asset account. So to decrease the bank account by 100$ we would credit it rather than debit it. (because credits decrease asset accounts (left side of the equation) and increase liability accounts(right side)).

We would also Debit the car insurance Expense account (because debits increase expense accounts and decrease revenue accounts (expenses and liabilities are often confused).

Hope this makes sense as it follows the initial logic you laid out.